real property gain tax 2018

2020-10-1The Internal Revenue Code is a labyrinth you might t hink that you have visited every room only to discover an opening that leads to yet another maze to explore. In a big way the pandemic has throttled the demand from foreign real estate investors to buy American homes.

How To Get Better Real Estate Deals Tips From The Pros Welease

For loans prior to this date the limit is 1 million.

. 2022-10-18This approach was dropped by the Tax Cuts and Jobs Act of 2017 starting with tax year 2018. If Land or house property is held for 36 months or less 24 months or less wef. If you held the property for one year or less its a short-term gain.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. They can be passive by default recharacterized as nonpassive eg net rental income generated from leasing to the taxpayers. 2015-10-22The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

NW IR-6526 Washington DC 20224. A transition rule in the new law provides that Section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before December 31 2017 or received replacement property. Assessment Of Real Property Gain Tax.

2 days agoAn exchange of real property held primarily for sale still does not qualify as a like-kind exchange. We welcome your comments about this publication and suggestions for future editions. 2021-6-30If you sell your rental property for 350000 it may seem like a loss but it is actually a 50000 gain for tax purposes.

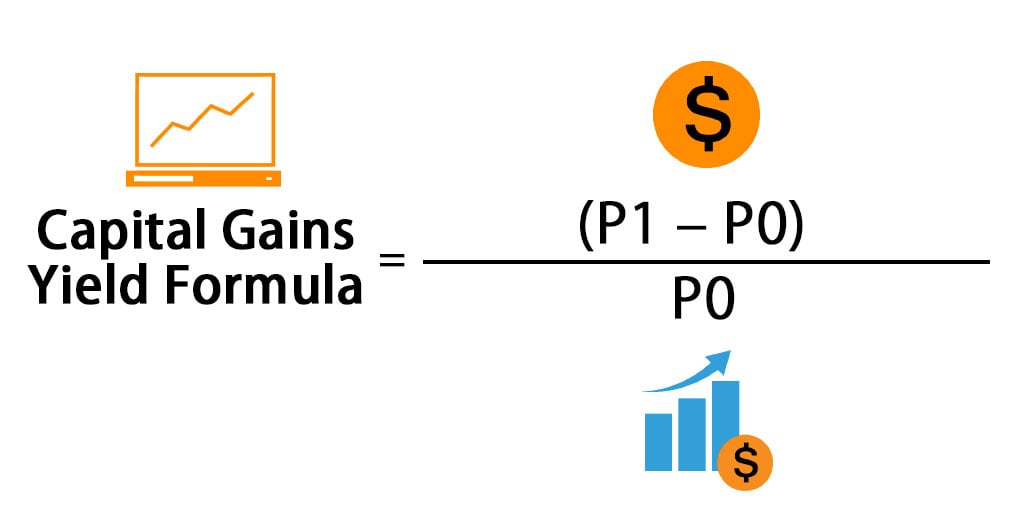

2022-10-18For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to buy build or improve your home. Republicans favor lowering the capital gain tax rate as an inducement to saving and investment. 2021-1-15When you sell a capital asset the difference between the purchase price of the asset and the amount you sell it for is a capital gain or a capital loss.

Rental real estate activities are found in several of the labyrinth rooms of the Code. Imposition Of Penalties And Increases Of Tax. Robert has a 5000 gain in tax year 2021.

2022-10-17Get the latest science news and technology news read tech reviews and more at ABC News. 2022-6-27Click on the link to find out how investing in Kansas City real estate can help you gain wealth. July 1998 2000 2001 May 2003 May 2003 2007.

FY 2017-18 then that Asset is treated as Short Term Capital Asset. 2020-12-31Because Robert wasnt personally liable for the debt the abandonment is treated as a sale or exchange of the property in tax year 2021. The CGT required is however lower than ordinary income tax.

2022-10-21They chose to treat Judy as a resident alien and filed joint 2018 and 2019 income tax returns. Real Property Tax Service RPTS maintains assessment rolls apportions the county levy among the 21 assessing jurisdictions in the county advises local assessors on procedural and legal changes updates tax maps processes title change data and reviews both new subdivision and re-subdivision maps for filing. From the period of 112014 until 31122018 disposal in the sixth year after the date of acquisition of the chargeable asset is nil.

Even if rental real estate rises to the level of a section 162 trade or business it is generally reported on Schedule E Part I because rental real estate is generally excluded from self-employment taxable income under section 1402a1. 2022-9-23For purposes of this section payment of a charitable contribution which consists of a future interest in tangible personal property shall be treated as made only when all intervening interests in and rights to the actual possession or enjoyment of the property have expired or are held by persons other than the taxpayer or those standing in a relationship to the taxpayer. Before the pandemic hit 2020 was shaping up to be another.

2022-8-6And very high-income taxpayers may pay a higher effective tax rate because of an additional 38 net investment income tax. Should there be a loss on the asset when sold it still needs to be declared when submitting your annual income tax assessment. Real Property Tax Service Office.

Cancellation Of Disposal Sales Transaction. 2022-8-20Although COVID has been bad for many of us in so many ways the pandemic did one good thing. Just as you pay income tax and sales tax gains from your home sale are subject to taxation.

1 day agoReuters the news and media division of Thomson Reuters is the worlds largest multimedia news provider reaching billions of people worldwide every day. ASCII characters only characters found on a standard US keyboard. Judy had remained a nonresident alien throughout the period.

Capital gains and losses are classified as long-term or short-term. Must contain at least 4 different symbols. Founded in 1998 Fortress manages assets on behalf of over 1900 institutional clients and private investors worldwide across a range of credit and real estate private equity and.

Fortress Investment Group LLC is a leading highly diversified global investment manager with approximately 444 billion 12 of assets under management as of June 30 2022. The pandemic helped protect American homebuyers from a resurgence in foreign real estate investors. As a real estate investor you can use this tax code called 1031 Exchange to sell an investment real estate and use the profit to buy a new one that is of equal or greater value.

2021-12-14If youre a real estate professional under section 469c7 but youre unable to satisfy the qualifications for the safe harbor youre not precluded from establishing that the gross income and gain or loss from the disposition of property associated with your rental real estate activity isnt included in net investment income. Reuters provides business financial. On January 10 2020 Dick became a nonresident alien.

The gain is considered an unrecaptured section 1250 gain and it is. For tax years after 2017 the limit is reduced to 750000 of debt for binding contracts or loans originated after December 16 2017. 2019-5-8It favors one narrow segment of the tax-paying public but does nothing for the rest of the states home buyers.

But Proposition 19 would just expand the inequities in Californias property tax system. 6 to 30 characters long. Complicating matters is the Tax Cuts and Jobs Act which took effect in 2018 and changed the rules.

2019-11-11What must be made clear however regardless of when the property was originally purchased CGT is payable if there is a profit gain on or after 01 October 2001. The measure shows the convoluted extremes that Californias tangled property tax system produces Los Angeles Times Editorial Board. Gain or loss from the sale or exchange of personal property generally has its source in the.

Or furniture that is not real property. Opting For 1031 Exchange in Real Estate. Roberts amount realized is 185000 and his adjusted basis in the property is 180000 as a result of 20000 of depreciation deductions on the property.

Of gains on the sale of real property if the owner owned and used it as primary residence for. 2022-10-21Rental real estate is usually reported on Schedule E Part I and is not subject to self-employment tax.

The Tax Cuts Jobs Act New Rules For Real Estate Owners Bny Mellon Wealth Management

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Selling And Perhaps Buying A Home Under The Tax Cuts And Jobs Act The Cpa Journal

The Real Property Business And The Tax Cuts Jobs Act Tax Law For The Closely Held Business

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Tax Tutorial 4 Doc Taxation Lll 2018 Tutorial 4 Rpgt Real Property Gains Tax Rates With Effect From Ya 2018 1 Co 2 Ind 3 Ind Disposed Within 3 Course Hero

An Overview Of Capital Gains Taxes Tax Foundation

Should Treasury Index Capital Gains Tax Policy Center

How To Calculate Capital Gains Tax H R Block

Solved I Did Not Understand My Topic During Online Class Please Help Me Course Hero

Capital Gains And Losses Sections 1231 1245 And 1250

Gl Property Consultancy Real Property Gains Tax Rpgt Is A Form Of Capital Gains Tax That Homeowners And Businesses Have To Pay When Disposing Of Their Property In Malaysia This Means

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Short Term Capital Gains Tax Rates For 2022 Smartasset

Capital Gains Yield Formula Calculator Excel Template

Zerin Properties Real Property Gains Tax

0 Response to "real property gain tax 2018"

Post a Comment